FNOL Explained Simply: What It Is, How It Works?

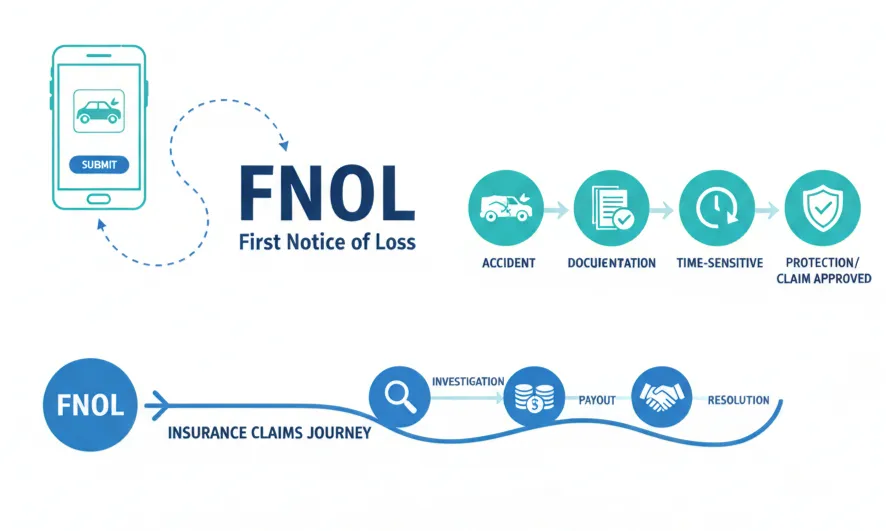

FNOL stands for First Notice of Loss. It refers to the very first time a loss or incident is officially reported. This could be after an accident, damage, theft or any unexpected event that causes loss. FNOL is not about paperwork or settlement it is simply about informing the concerned system or organization that something has happened.

At its core, FNOL is a communication step. It creates a starting record that allows the next actions to happen in an organized way. Without FNOL, losses remain untracked, unclear and unmanaged.

What Is FNOL in Simple Terms?

FNOL is the initial alert. It answers one basic question:

“Something went wrong here is what happened.”

This notice usually includes:

- What happened

- When it happened

- Where it happened

- Who is affected

It does not require full proof, detailed investigation or final decisions. FNOL exists to make sure the loss is acknowledged early, while details are still fresh and accurate.

How FNOL Actually Works?

FNOL follows a straightforward flow that most people experience without realizing it.

First, a loss event occurs. This could be a vehicle accident, damaged property, missing item or similar situation. Next, the affected person reports the event through an available channel such as a phone call, online form, mobile app or assisted support system.

Once reported, the FNOL information is recorded in a system. This record becomes the reference point for everything that follows. From there, further review, verification and actions are planned based on the information captured at FNOL.

The key thing to understand is that FNOL does not finalize anything. It simply ensures that the loss is logged early and correctly.

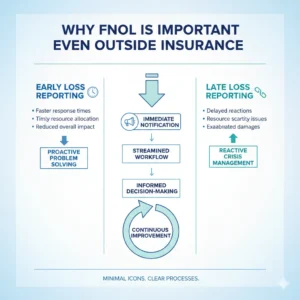

Why FNOL Is Important Even Outside Insurance?

Although FNOL is widely used in insurance, the concept applies anywhere loss tracking is important. Early reporting prevents confusion, missing details and delayed responses.

When FNOL is done late or poorly:

- Details may be forgotten or incorrect

- Decisions may be delayed

- Extra follow-ups become necessary

When FNOL is done properly:

- Information stays accurate

- Processes move faster

- Fewer misunderstandings occur

This is why FNOL is often treated as a foundation step rather than a formality.

Who Needs FNOL and Why?

FNOL is needed by anyone involved in managing loss, risk or recovery.

This includes individuals who experience a loss and need it recorded organizations that track incidents for accountability and service teams that need accurate information to respond effectively.

FNOL ensures that all parties start from the same understanding of the event, rather than piecing information together later.

One Insurance-Specific View: FNOL in Insurance

In insurance, FNOL is the starting point of the claims journey. It allows insurers to open a claim record, verify coverage and plan next steps. The quality of FNOL data directly affects how smoothly a claim progresses.

However, FNOL itself is not the claim. It is simply the first notice that allows the claim process to begin in a structured way. This is where FNOL Automation in Insurance becomes especially important by ensuring that early loss information is captured accurately, consistently and without unnecessary delays, insurers can build a stronger foundation for the entire claims journey.

Common FNOL Mistakes People Make

Many problems related to FNOL come from misunderstanding its purpose.

Some people delay FNOL, thinking they need full details first. Others provide very limited information, assuming details can be added later. Both approaches can slow things down.

FNOL works best when it is:

- Reported early

- Honest and clear

- As complete as possible at the time

Perfection is not required clarity is.

FNOL vs “Taking Action”: A Simple Difference

FNOL is about reporting, not resolving.

Action comes later.

Think of FNOL as pressing the “start” button. It does not decide outcomes, but without it, nothing else moves forward.

Conclusion: Why FNOL Matters More Than People Think?

FNOL may sound technical, but it is a very human process. It exists to capture a moment when something unexpected happens and turn it into structured information.

When FNOL is handled well, everything that follows becomes easier, clearer and faster. When it is ignored or rushed, small gaps turn into big problems later. Understanding FNOL simply means understanding the importance of early, clear communication when a loss occurs.

In insurance, FNOL sets the direction for the entire claims journey. If you’re looking for clear, practical guidance on improving FNOL within insurance operations, AmityFin is here to help. Speak directly with an insurance specialist at +1 (888) 914-8699.

Recent posts

-

Digital Transformation in Insurance: How Technology is Reshaping the Future of the Industry

05 Feb, 2026 -

AI Auto Insurance: How Artificial Intelligence is Revolutionizing Car Insurance in the USA

05 Feb, 2026 -

Insurance Automation System: How Automation Is Transforming the Insurance Industry?

22 Jan, 2026